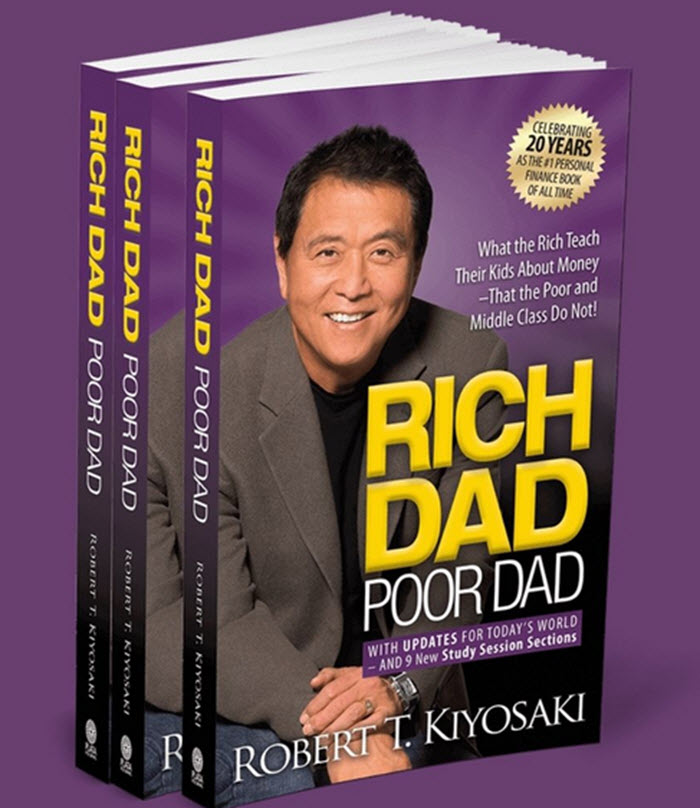

“Rich Dad Poor Dad,” written by Robert Kiyosaki and published in 1997, is a best-selling personal finance book that has gained widespread popularity for its unique perspective on wealth-building and financial education. This article will delve into the key lessons and principles presented in “Rich Dad Poor Dad,” as well as the impact it has had on the world of personal finance and wealth management.

The Premise of Rich Dad Poor Dad

Two Fathers, Two Different Approaches to Money

“Rich Dad Poor Dad” is based on Kiyosaki’s own life experiences growing up in Hawaii, where he had the influence of two father figures: his biological father (Poor Dad) and his best friend’s father (Rich Dad). Both men had vastly different mindsets and approaches to money and financial success, which Kiyosaki uses as the foundation for the lessons he shares in the book.

Poor Dad, a well-educated and hardworking man, believed in the traditional path of pursuing higher education, getting a good job, and saving for retirement. Rich Dad, on the other hand, was an entrepreneur who advocated for financial education and the development of assets to generate passive income.

Key Lessons from Rich Dad Poor Dad

The Importance of Financial Education

One of the main principles emphasized in “Rich Dad Poor Dad” is the importance of financial education. Kiyosaki argues that the traditional education system does not teach people how to manage their finances effectively or build wealth, leaving many individuals ill-equipped to achieve financial success.

To remedy this, Kiyosaki encourages readers to seek out financial education and become financially literate, learning about topics such as budgeting, investing, and asset management. This knowledge will help individuals make informed financial decisions and develop effective strategies for wealth-building.

Assets versus Liabilities

Another central lesson in “Rich Dad Poor Dad” is the distinction between assets and liabilities. Kiyosaki defines assets as things that put money in your pocket, while liabilities are things that take money out of your pocket. According to Kiyosaki, the key to building wealth is to acquire assets and minimize liabilities.

Rich Dad’s approach to wealth-building involved focusing on purchasing income-generating assets, such as real estate and businesses, rather than accumulating consumer debt or relying on a traditional job. By developing a portfolio of assets that generate passive income, individuals can achieve financial freedom and break the cycle of living paycheck to paycheck.

The Power of Entrepreneurship

Kiyosaki also advocates for the power of entrepreneurship as a means of achieving financial success. Rather than relying on a job for income, Kiyosaki encourages readers to consider starting their own businesses or investing in others’ businesses to create additional streams of income.

By embracing entrepreneurship, individuals can develop new skills, increase their earning potential, and create opportunities for passive income, ultimately contributing to their overall financial well-being.

The Importance of Mindset

A recurring theme in “Rich Dad Poor Dad” is the importance of having the right mindset when it comes to money and wealth-building. Kiyosaki emphasizes that individuals must shift their mindset from seeing money as a scarce resource to recognizing its potential for abundance.

By adopting a mindset of abundance and focusing on opportunities for growth and wealth creation, individuals can overcome financial challenges and work towards achieving their financial goals.

The Impact of Rich Dad Poor Dad

Influencing a Generation of Wealth-Builders

“Rich Dad Poor Dad” has had a significant impact on the world of personal finance and wealth management since its publication. The book has sold millions of copies worldwide, and its principles have resonated with countless readers looking to improve their financial situations.

Many successful entrepreneurs and investors have credited “Rich Dad Poor Dad ” with providing them the foundational knowledge and inspiration to pursue their own wealth-building journeys. By challenging conventional wisdom and offering alternative perspectives on financial success, Kiyosaki’s book has encouraged a generation of individuals to think differently about money, investing, and entrepreneurship.

Expanding the Rich Dad Brand

The success of “Rich Dad Poor Dad” has led Kiyosaki to expand the Rich Dad brand, which now includes additional books, educational materials, seminars, and coaching programs. These resources aim to help individuals further develop their financial education, gain practical skills, and implement the principles discussed in “Rich Dad Poor Dad” in their own lives.

Some of the other popular titles in the Rich Dad series include “Cashflow Quadrant,” “Rich Dad’s Guide to Investing,” and “Retire Young Retire Rich.” These books delve deeper into specific aspects of personal finance and wealth-building, offering readers additional insights and strategies for achieving financial success.

Criticisms and Controversies

While “Rich Dad Poor Dad” has undoubtedly had a significant impact on personal finance and wealth-building, it has not been without its share of criticisms and controversies. Some critics argue that the book oversimplifies complex financial concepts or promotes risky investment strategies that may not be suitable for all readers.

Additionally, there has been debate surrounding the true identity of Kiyosaki’s Rich Dad, with some suggesting that the character may be a fictional creation rather than a real person. Despite these criticisms, the book’s core principles and lessons resonate with many individuals seeking to improve their financial situations and achieve wealth.

This article was last updated on: April 23, 2023